A claims documentation service is a critical tool for auto body shops, simplifying claim handling and record-keeping, leading to faster reimbursements, enhanced efficiency, and improved customer satisfaction. These services are essential for industry audits, providing comprehensive records for financial verification and discrepancy identification. Engaging such a service offers significant benefits in precise record-keeping, freeing up resources for core operations, especially in auto maintenance and fleet repair industries where accurate tracking of repairs is vital for insurance claims.

In today’s regulated landscape, maintaining accurate and compliant claims documentation is crucial for any organization. This article delves into the vital role played by a robust claims documentation service, exploring how it streamlines operations and ensures audit-readiness. We’ll dissect the intricate audit process and its specific documentation requirements, highlighting why partnering with an expert provider offers significant advantages.

- Understanding the Role of Claims Documentation Service

- Audit Process and Its Demands on Documentation

- Benefits of Engaging an Audit-Ready Documentation Provider

Understanding the Role of Claims Documentation Service

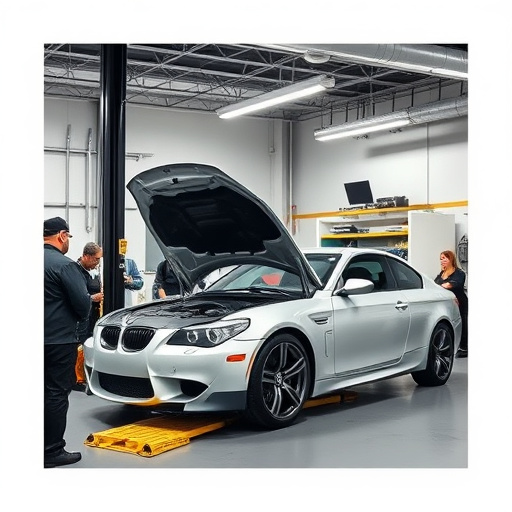

A claims documentation service plays a pivotal role in streamlining the process of filing and managing insurance claims, particularly within the auto body shop industry. This specialized service ensures that all necessary documentation for car paint repair or car dent repair is accurate, complete, and compliant with regulatory requirements. By leveraging this service, auto body shops can significantly reduce the administrative burden associated with processing claims, enabling them to focus more on providing quality services to their customers.

In today’s competitive landscape, maintaining thorough and organized records for each repair job, including detailed estimates, before-and-after photos, and comprehensive descriptions of work performed, is essential. A claims documentation service not only facilitates this organization but also ensures that all supporting documents are readily available when needed, minimizing delays in claim processing. This efficiency translates into faster reimbursement for the auto body shop, enhancing their overall operational effectiveness and customer satisfaction levels.

Audit Process and Its Demands on Documentation

The audit process is a critical phase for any business, especially those offering specialized services like car dent repair or tire services and luxury vehicle repair. It involves an in-depth examination of financial records, procedures, and internal controls to ensure compliance with industry standards and regulations. During an audit, meticulous record-keeping and well-organized documentation are paramount. This is where a robust claims documentation service plays a pivotal role.

Auditors demand comprehensive and easily accessible documentation to verify expenses, track service history, and assess the accuracy of financial statements. For businesses in the automotive sector, this includes detailed records of parts used, labor costs, and customer claims related to repairs like car dent repair or luxury vehicle customization. Efficient claims documentation streamlines the audit process, allowing auditors to quickly validate information, identify potential discrepancies, and provide a clear picture of the company’s financial health.

Benefits of Engaging an Audit-Ready Documentation Provider

Engaging a dedicated claims documentation service offers numerous advantages for businesses, especially those in industries that heavily rely on accurate record-keeping. This specialized provider ensures that all documentation related to claims is organized, up-to-date, and compliant with regulatory standards. By outsourcing this task, companies can free up valuable time and resources, allowing them to focus on their core operations.

Moreover, a professional claims documentation service streamlines the entire process, from claim submission to resolution. They possess the expertise and technology to efficiently manage and retrieve documents, ensuring that every detail is accounted for. This is particularly beneficial in sectors such as auto maintenance and fleet repair services, where accurate tracking of repairs, parts, and labor costs is essential. Even common issues like car dent repairs require meticulous documentation for insurance claims.

A robust claims documentation service is no longer a nice-to-have, but a necessity in today’s business landscape. With increasing regulatory scrutiny and the need for accurate, audit-ready records, engaging a specialized provider offers significant advantages. By outsourcing this critical function, organizations can streamline their processes, reduce errors, and focus on core competencies while ensuring compliance and boosting operational efficiency. Investing in a high-quality claims documentation service is a strategic move that fosters trust, transparency, and financial integrity.